For the ultra-wealthy, traditional banking services barely scratch the surface of available financial opportunities. Private banking, a domain reserved for individuals with liquid assets typically exceeding $10 million, offers a suite of sophisticated services that go far beyond standard wealth management.

SECURITY | MillionairesXchange

The Evolution of Private Banking

Private banking has transformed dramatically from its Swiss origins in the 18th century. Today's private banking landscape combines centuries-old discretion with cutting-edge financial technology and global investment opportunities. This evolution reflects the increasingly complex needs of ultra-high-net-worth individuals (UHNWIs) in a rapidly changing global economy.

Core Services of Modern Private Banking

Bespoke Investment Strategies

Private banks develop highly personalized investment strategies that consider:

- Global market opportunities across all asset classes

- Tax optimization across multiple jurisdictions

- Risk management tailored to family wealth preservation

- Alternative investment access, including pre-IPO opportunities

- Custom structured products designed for specific client needs

Family Office Services

Modern private banking often includes comprehensive family office support:

- Intergenerational wealth transfer planning

- Family governance structures

- Educational programs for next-generation family members

- Philanthropy advisory services

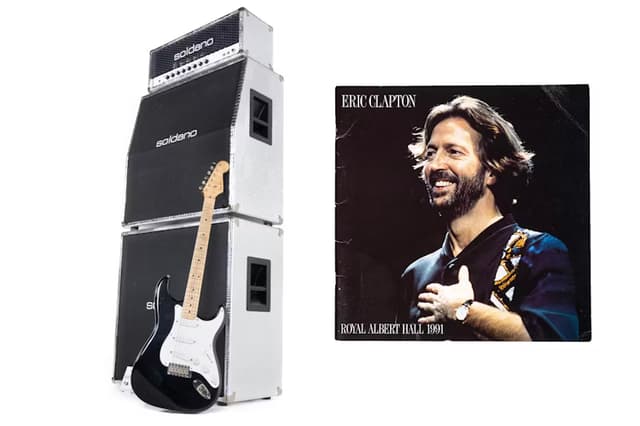

- Art and collectibles management

Exclusive Lending Solutions

Private banks offer sophisticated lending options unavailable in traditional banking:

- Aircraft and yacht financing

- Art-secured lending

- Real estate portfolio financing

- Business acquisition loans

- Custom credit structures for unique opportunities

The Architecture of Privacy

Privacy remains fundamental to private banking, with sophisticated structures including:

Legal Framework

- Multiple-jurisdiction asset protection

- Complex trust structures

- Private investment vehicles

- Confidential ownership arrangements

Security Measures

- Advanced digital security protocols

- Discrete physical security services

- Confidential communication channels

- Protected document storage and transmission

Investment Opportunities Beyond Traditional Markets

Private banking clients gain access to exclusive investment opportunities:

Pre-IPO Investments

- Direct access to late-stage private companies

- Preferred allocation in upcoming public offerings

- Secondary market opportunities in private shares

Alternative Investments

- Private equity co-investment opportunities

- Direct real estate investment consortiums

- Exclusive hedge fund access

- Rare commodity investments

Global Perspective and Local Expertise

Modern private banking combines:

International Reach

- Cross-border investment opportunities

- Multi-currency management

- Global real estate access

- International business expansion support

Local Knowledge

- Region-specific tax expertise

- Local market intelligence

- Cultural understanding

- Regulatory compliance across jurisdictions

Technology Integration in Private Banking

Today's private banking leverages advanced technology:

Digital Platforms

- Secure communication channels

- Real-time portfolio monitoring

- Custom reporting interfaces

- Digital document management

Data Analytics

- Predictive investment modeling

- Risk analysis algorithms

- Market trend analysis

- Portfolio optimization tools

Relationship Management Excellence

The cornerstone of private banking remains the relationship manager:

Personal Service

- 24/7 availability

- Deep understanding of client needs

- Proactive opportunity identification

- Crisis management support

Professional Network

- Access to top legal experts

- Connection to industry leaders

- Introduction to investment opportunities

- Luxury lifestyle services

Risk Management and Wealth Preservation

Private banks excel in sophisticated risk management:

Portfolio Protection

- Advanced hedging strategies

- Currency risk management

- Political risk mitigation

- Market volatility protection

Wealth Preservation

- Long-term preservation strategies

- Inflation protection

- Generation-spanning planning

- Crisis preparation

Lifestyle Services and Concierge

Beyond financial services, private banks often provide:

Lifestyle Management

- Luxury property acquisition

- Private jet and yacht arrangements

- Art collection management

- Exclusive event access

Educational Services

- Financial literacy programs

- Next-generation training

- Business management education

- Investment strategy workshops

Future Trends in Private Banking

The private banking sector continues to evolve:

Digital Integration

- Blockchain technology adoption

- AI-powered investment analysis

- Enhanced cybersecurity measures

- Digital asset management

Sustainable Focus

- ESG investment integration

- Impact investing opportunities

- Sustainable wealth management

- Green investment products

Conclusion

Private banking represents the pinnacle of financial services, offering ultra-high-net-worth individuals a comprehensive suite of solutions that extend far beyond traditional banking. As global wealth continues to grow and financial markets become increasingly complex, the role of private banking in preserving and growing substantial wealth becomes ever more crucial.

The future of private banking lies in its ability to combine traditional values of discretion and personalized service with innovative technology and sustainable practices. For those who qualify, private banking offers unparalleled opportunities for wealth preservation, growth, and generational transfer.