High-End Foreclosures and Seized Assets: The Elite Investor's Guide

Luxury foreclosures and seized assets represent a unique investment opportunity for high-net-worth individuals seeking to acquire premium properties at below-market values. This comprehensive guide explores the intricacies of this specialized market segment.

Understanding the Luxury Foreclosure Market

The high-end foreclosure market operates differently from standard foreclosures, with unique characteristics and opportunities:

Market Dynamics

- Limited public visibility

- Complex ownership structures

- Multiple lien holders

- International property considerations

- Specialized financing requirements

Types of Available Assets

- Real Estate: Luxury residences, private islands, commercial properties, development sites, multi-property portfolios

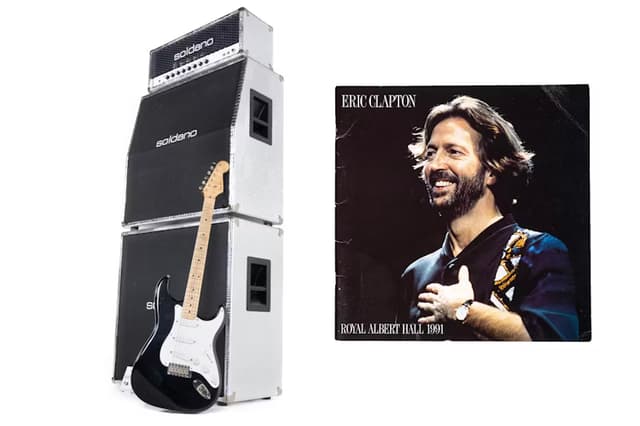

- Movable Assets: Private aircraft, luxury yachts, exotic car collections, fine art collections, high-value jewelry

Access Channels

- Banking Relationships: Private bank asset disposition units, special asset departments, portfolio liquidation teams, cross-border asset recovery, institutional partnerships

- Government Sources: Federal asset seizures, state-level forfeitures, tax authority auctions, customs seizures, regulatory actions

Due Diligence Requirements

- Legal Investigation: Title verification, lien status, ownership disputes, foreign jurisdiction issues, regulatory compliance

- Financial Analysis: Market value assessment, renovation requirements, operating costs, tax implications, exit strategy planning

Investment Strategies

Direct Acquisition

- Individual property purchase

- Portfolio purchases

- Joint ventures

- Entity acquisition

- Structured transactions

Indirect Investment

- Distressed asset funds

- Special situation partnerships

- Private equity vehicles

- Asset-backed securities

- Debt acquisition strategies

Risk Management

- Legal Risks: Title issues, environmental liabilities, regulatory compliance, cross-border complications, ownership disputes

- Financial Risks: Market timing, valuation uncertainty, rehabilitation costs, carrying expenses, exit timing

Financing Options

Traditional Sources

- Private banking facilities

- Asset-based lending

- Bridge financing

- Syndicated loans

- Portfolio financing

Alternative Solutions

- Hard money lenders

- Private capital

- Family office funding

- Cross-collateralization

- International financing

Asset Management

Property Preservation

- Security measures

- Maintenance programs

- Insurance coverage

- Environmental compliance

- Property management

Value Enhancement

- Strategic improvements

- Market positioning

- Tenant acquisition

- Operating efficiency

- Brand development

Exit Strategies

Direct Sale

- Private treaty sales

- Auction processes

- Broker networks

- International marketing

- Portfolio sales

Alternative Exits

- Property development

- Joint ventures

- Long-term holds

- Partial dispositions

- Operating business creation

Conclusion

The luxury foreclosure and seized asset market presents unique opportunities for sophisticated investors who understand its complexities and challenges. Success requires careful due diligence, strong professional relationships, and a comprehensive understanding of both local and international markets. As this sector continues to evolve, staying informed about market trends and maintaining strong networks becomes increasingly important for identifying and capitalizing on premium opportunities.